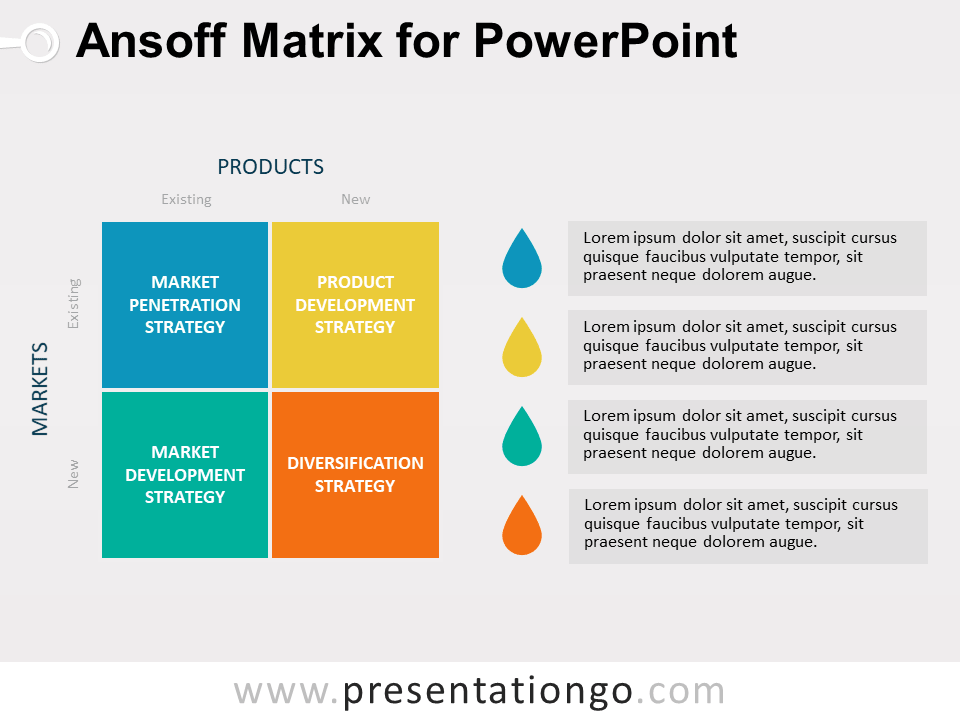

Pets are unnecessary they are evidence of failure to either obtain a leadership position or to get out and cut the losses. All products will eventually become either cash cows or pets. Companies should liquidate, divest, or reposition these “pets.”Īs can be seen, product value depends entirely on whether or not a company is able to obtain a leading share of its market before growth slows. Companies should invest in or discard these “question marks,” depending on their chances of becoming stars. Companies should significantly invest in these “stars” as they have high future potential. The Boston Matrix, also called The Boston Consulting Group (BCG) Matrix, is a simple, visual way to examine the likely financial performance of your product. Companies should milk these “cash cows” for cash to reinvest. It's when an organization attempts to grow in a market it already exists in with products, services or other offerings it already has. The matrix reveals two factors that companies should consider when deciding where to invest-company competitiveness, and market attractiveness-with relative market share and growth rate as the underlying drivers of these factors.Įach of the four quadrants represents a specific combination of relative market share, and growth: The four growth strategies within the Ansoff Matrix include: Market penetration The market penetration strategy is the first quadrant of the Ansoff Matrix and provides the least risk of the four growth options. These high growth rates then signal which markets have the most growth potential.

Ultimately, the market leader obtains a self-reinforcing cost advantage that competitors find difficult to replicate.

The growth share matrix was built on the logic that market leadership results in sustainable superior returns. Technology, Media, and Telecommunications.

0 kommentar(er)

0 kommentar(er)